Jan 17, 2022

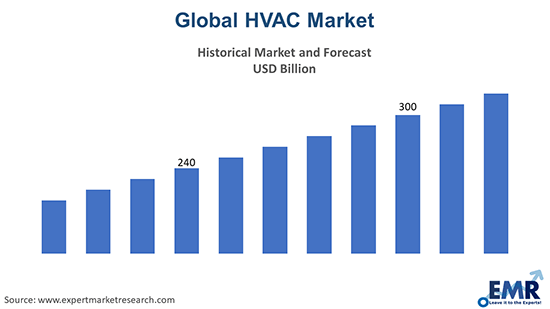

Since 2021, with the acceleration of global vaccination and the successive lifting of blockade measures by various countries, the recovery of the world economy has remarkably improved. But the pandemic is continuing, and people in many parts of the world are still working from home. Life, work, and study have not returned to normal.

In 2021, the weather in most parts of the world was not very hot, and there are some areas where the weather is seasonable, but due to the pandemic, excellent opportunities for air conditioner sales were missed. Stay-at-home demand continues to drive the residential market, but the growth momentum has significantly weakened compared with 2020. There are apparent differences in the increases and decreases in needs in various regions.

In 2021, the weather in most parts of the world was not very hot, and there are some areas where the weather is seasonable, but due to the pandemic, excellent opportunities for air conditioner sales were missed. Stay-at-home demand continues to drive the residential market, but the growth momentum has significantly weakened compared with 2020. There are apparent differences in the increases and decreases in needs in various regions.

From the end of 2020 until the beginning of 2021, the pandemic situation in some areas has been temporarily controlled. Soon after starting, many projects were forced to stop immediately due to the worsening of the pandemic. The intermittent shock wave of the pandemic hit the recovering packaged air conditioner (PAC) market. The global PAC market has increased by 3.1% year on year, but it has not yet returned to the level of 2019.

The U.S. market continues to maintain rapid growth. Total demand in 2021 has reached 24.33 million units, a year-on-year increase of 6.9%. Both ducted and ductless air conditioning systems continue to expand. In addition to benefiting from the weather, the pandemic subsidy policy and home office trend have also extensively promoted consumption. According to statistics issued by the Air-Conditioning, Heating, and Refrigeration Institute (AHRI), in November 2021, the unitary market has grown by 9.2% year on year. JARN estimates that single-split type and window-type RACs in the United States increased by 14.1% and 2.3% in 2021, respectively.

The Latin American market was hit hard by the pandemic in 2020 but has begun to recover. JARN estimates that the Latin American market increased by 10.3% to 9.37 million units. The average temperature in Brazil is relatively high, and the air conditioning penetration rate is low. High growth in the construction segment is due to a construction boom and the recent improvement in Brazil’s housing credit system, and it has also benefitted from a decline in interest rates in recent years.

The European RAC market was not only affected by a cool summer, but also by weakening stayat-home demand. The French and German markets, which have been growing for the past two years, are starting to stall in 2021, and the Benelux market has not grown as expected. JARN estimates RAC demand in 2021 increased by 4.9% compared with 2020, reaching 7.45 million units. The renewal demand for PACs in stores was delayed. The lockdown was lifted in March 2021, so the projects postponed in 2019 resumed.

The weather in the summer of 2021 in China was unpredictable, and factors such as the real estate downturn have dragged down the recovery of the air conditioning market. The Chinese market has improved slightly, with an increase of only 2.6% over 2020. However, the upgrading of air conditioning products is accelerating, and the new energy efficiency standard requirements have been enforced in 2021. Driven by this policy, noninverter RACs that do not meet the standards have been eliminated. The quality of inverter RACs has been significantly upgraded. The inverter penetration rate has reached 73.5%. In Southeast Asia, the weather was terrible in the first half of 2021 due to the La Niña phenomenon. Due to the influence of the Delta variant, the number of infected people in Southeast Asian countries has increased significantly in 2021 compared with 2020. Many countries have implemented strict restrictions such as lockdowns.

JARN predicts that in 2021, the RAC market in the seven major Southeast Asian countries has increased by only 1.4% year on year to 5.98 million units.

The African RAC market in 2021 was relatively smooth, with an increase of 3.1% to 3.44 million units. In 2021, many countries in Africa strengthened trade protection measures, and some countries increased their import tax rates on air conditioners to more than 40%. Many African countries have begun to import complete knockdown (CKD) or semi-knock-down (SKD) products from China and are assembling them in their own countries. Therefore, the number of air conditioners produced locally in Africa has dramatically increased. On the contrary, the number of air conditioners exported from China to Africa dropped significantly.

In Australia, in summer 2021, heavy rain and lower than usual temperatures are occurring due to the La Niña phenomenon. The Australian air conditioner market in 2021 was expected to achieve a single-digit growth.

According to statistics from the Japan Refrigeration and Air Conditioning Industry Association (JRAIA), the total number of RACs shipped in 2021 is estimated to have reached around 9.45 million units in Japan, indicating negative growth of about 4.2%. The total number of PACs shipped in 2021 is estimated to be around 825,000 units, indicating the same level as 2020. But the PAC market has not recovered by the same level as 2019 due to the state of emergency issued during most of the year 2021.